From 1st January 2021, there will be a change in the way we handle orders for you.

As a valued EU customer, we have summarised the information in three simple steps below:

1. Ordering From Our Website:

All prices on our website will now be displayed as a gross amount (excluding tax) for all customers outside the UK.

All EU individuals and businesses will pay 0% VAT on our website.

2. Invoicing And Order Confirmations:

All invoices from us will show no VAT element in the subtotal since no VAT will be paid. The shipping costs shown on your invoice will not contain any additional import fees.

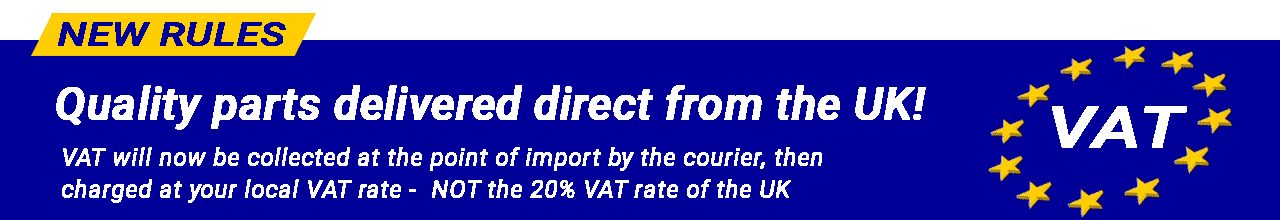

3. Delivery And EU Vat (Important):

All parts on our website are delivered direct to your door from the UK, a commercial invoice and customs declaration will be included with your parcel.

The courier responsible for your order will contact you at the point of import to your country to collect a VAT charge, which is calculated at your local VAT rate – NOT the 20% VAT rate of the UK. The VAT charge is remitted to your local VAT authority by the courier, and EU VAT Registered businesses can claim this amount in their annual tax return.

You will receive these payment requests in the same way you currently receive tracking updates from your courier – the process is quite smooth and hassle-free.

Once any outstanding charges are collected, the shipment will progress as normal and this will be reflected in your tracking history.

If the charges are not paid, the parcel will return to us and the customer will be liable for any Customs Penalties that we receive, so we ask that all customers understand the new process before placing an order.

Take advantage of Low Prices & Fast Delivery